Our annual Market Overview offers a comprehensive and unique perspective on the private markets investment landscape, leveraging our firm’s industry expertise, research capabilities and expansive database to help navigate what may lie ahead for the industry.

2025 Market Overview

This year, we set out to take a clear and data-driven view of the state of private markets and where we see opportunities, dispel “facts” that are actually just opinions, and highlight what investors should be paying attention to (maybe even worrying about) for 2025 and beyond.

Explore Key Highlights

Definitions and Disclosures

EVOLVING LANDSCAPE OF INVESTMENT CONVENIENCE

EVERGREEN FUND GROWTH OVER TIME

Evergreen Funds

Can you have too much of a good thing? According to this chart, no. The various types of evergreen funds that have exploded recently show no signs of slowing down. 415 new funds were launched between 2017 and 2023, and we hear anecdotal discussions of hundreds of new funds under discussion and development at any point in time today.

Fundraising

When companies and funds are too big to be small and too small to be big, where do they go? Nowhere fast. That's why we define the middle market as sub-$3 billion instead of the traditional $5-$10 billion. There's more opportunity there.

Let’s get real. For most investors, they gave private markets managers money with the expectation that it would come back in some reasonable time period. While distributions picked up in 2024, for many, they're still asking, "when can I get my money?" Let's take a closer look.

Liquidity

TIME TO DEPLOY CAPITAL OVERHANG

PRIVATE EQUITY & PRIVATE CREDIT

Forget capital overhang, we believe this is the chart that matters. Measuring the ratio of deal activity to dry powder we see the points in time markets have done best are after periods in which there is a great deal of overhang, generally because deal activity has slowed. That’s the environment we are in today.

Investment Activity

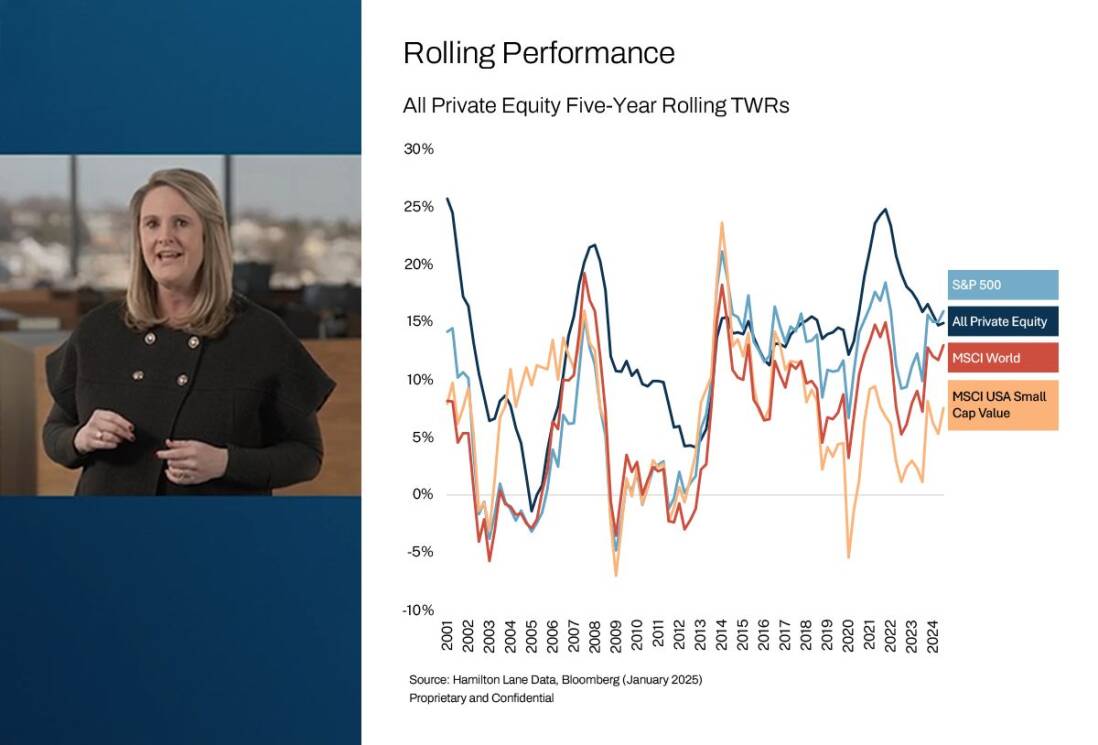

Very few of us are investing solely for short-term returns. They matter, but the longer term is why we are in markets, especially the private markets. And those returns look pretty great.

Performance

A Glimpse Inside the Report

Discover the latest insights from Hamilton Lane’s global survey of over 300 investment advisors. Key findings reveal that diversification and performance continue to drive private wealth interest in the asset class.

Global Private Wealth Survey

Our proprietary software, Cobalt™, provides investors with the same insights and tools leveraged by Hamilton Lane’s experts around the world (including in the making of our annual Market Overview). Unlock the private markets and power your market research, investment due diligence, portfolio construction and analytics.

Transforming data into insight and action.

2025 Market Overview

Our annual Market Overview offers a comprehensive and unique perspective on the private markets investment landscape, leveraging our firm’s industry expertise, research capabilities and expansive database to help navigate what may lie ahead for the industry.

This year, we set out to take a clear and data-driven view of the state of private markets and where we see opportunities, dispel “facts” that are actually just opinions, and highlight what investors should be paying attention to (maybe even worrying about) for 2025 and beyond.

Explore Key Highlights

Discover the latest insights from Hamilton Lane’s global survey of over 300 investment advisors. Key findings reveal that diversification and performance continue to drive private wealth interest in the asset class.

Global Private Wealth Survey

Our proprietary software, Cobalt™, provides investors with the same insights and tools leveraged by Hamilton Lane’s experts around the world (including in the making of our annual Market Overview). Unlock the private markets and power your market research, investment due diligence, portfolio construction and analytics.

Transforming data into insight and action.